Strategic Collaborations for Strength: Bagley Risk Management

Strategic Collaborations for Strength: Bagley Risk Management

Blog Article

Exactly How Livestock Danger Defense (LRP) Insurance Coverage Can Secure Your Livestock Financial Investment

Animals Threat Protection (LRP) insurance coverage stands as a reliable guard against the unpredictable nature of the market, offering a critical method to securing your properties. By diving into the intricacies of LRP insurance policy and its diverse benefits, livestock manufacturers can fortify their investments with a layer of security that transcends market variations.

Understanding Animals Risk Defense (LRP) Insurance Coverage

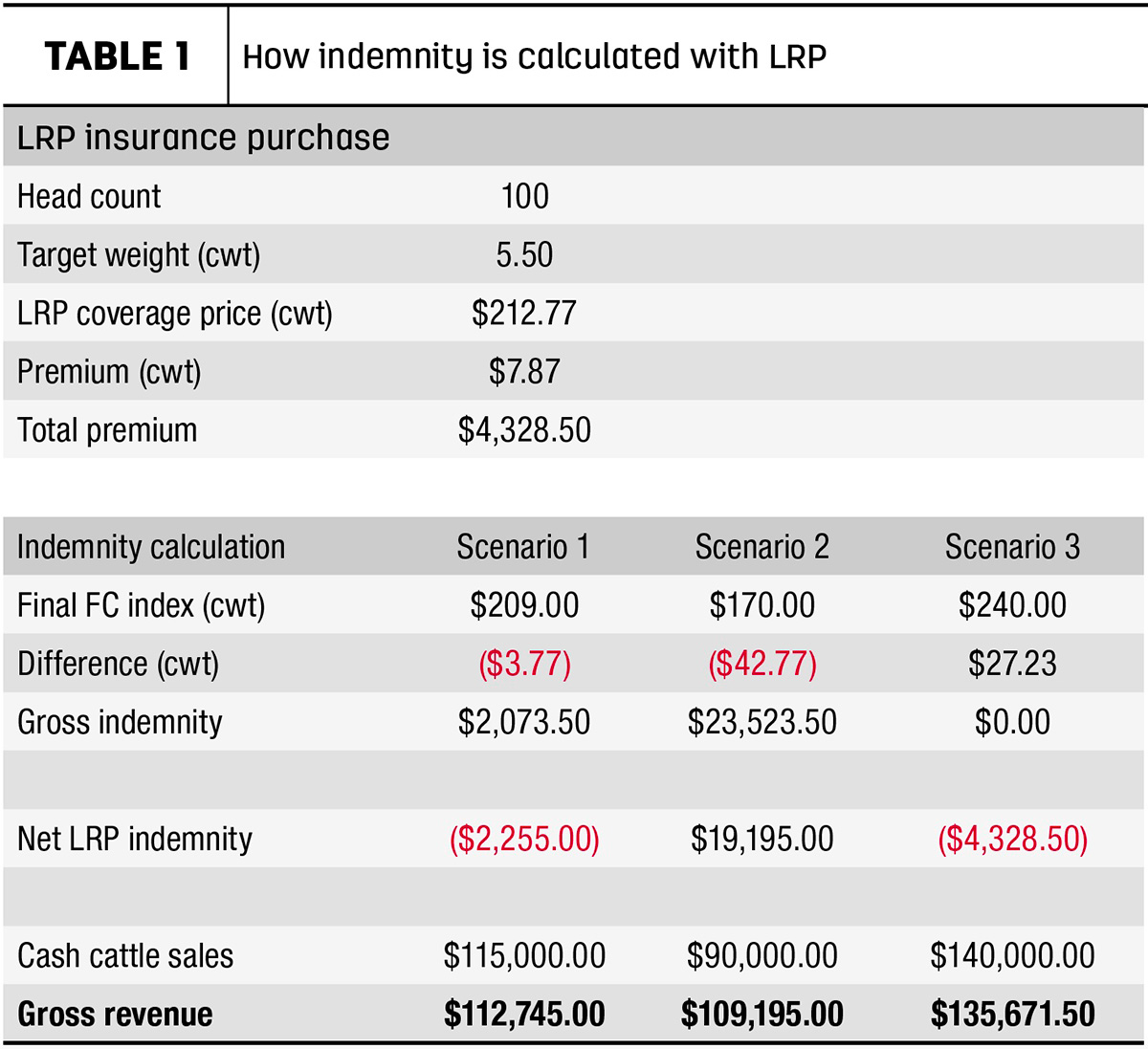

Comprehending Livestock Threat Defense (LRP) Insurance coverage is essential for livestock manufacturers seeking to mitigate monetary dangers connected with rate variations. LRP is a federally subsidized insurance policy item developed to protect manufacturers versus a decrease in market costs. By supplying protection for market value decreases, LRP assists manufacturers secure a floor cost for their animals, making sure a minimum level of income no matter market changes.

One trick facet of LRP is its adaptability, permitting manufacturers to customize insurance coverage levels and policy sizes to match their certain requirements. Manufacturers can pick the number of head, weight range, coverage price, and insurance coverage period that line up with their manufacturing goals and risk tolerance. Comprehending these personalized choices is vital for producers to efficiently handle their rate risk direct exposure.

Furthermore, LRP is offered for different livestock types, including livestock, swine, and lamb, making it a functional threat monitoring tool for livestock producers across different fields. Bagley Risk Management. By acquainting themselves with the ins and outs of LRP, producers can make informed decisions to secure their investments and make certain monetary security in the face of market uncertainties

Benefits of LRP Insurance for Animals Producers

Livestock producers leveraging Animals Danger Security (LRP) Insurance coverage obtain a tactical benefit in securing their investments from rate volatility and safeguarding a secure monetary ground in the middle of market unpredictabilities. One crucial advantage of LRP Insurance coverage is rate protection. By establishing a floor on the cost of their livestock, manufacturers can reduce the danger of considerable financial losses in case of market downturns. This enables them to prepare their spending plans better and make informed decisions about their procedures without the continuous concern of price variations.

In Addition, LRP Insurance supplies producers with peace of mind. Understanding that their investments are protected versus unanticipated market changes permits manufacturers to concentrate on other aspects of their organization, such as improving pet health and wellness and well-being or maximizing manufacturing procedures. This assurance can result in increased performance and earnings in the future, as producers can operate with more self-confidence and stability. Overall, the benefits of LRP Insurance policy for livestock producers are significant, providing an important device for managing threat and ensuring monetary safety and security in an unforeseeable market atmosphere.

Just How LRP Insurance Mitigates Market Risks

Minimizing market dangers, Animals Threat Defense (LRP) Insurance coverage supplies livestock manufacturers with a dependable shield versus rate volatility and monetary unpredictabilities. By offering protection versus unforeseen price decreases, LRP Insurance coverage aids manufacturers safeguard their investments and keep monetary security despite market changes. This kind of insurance allows livestock manufacturers to lock in a rate for their pets at the start of the policy duration, ensuring a minimum rate level regardless of market changes.

Steps to Safeguard Your Livestock Investment With LRP

In the realm of farming risk monitoring, executing Livestock Threat Protection (LRP) Insurance involves a tactical procedure to safeguard financial investments versus market changes and uncertainties. To protect your animals investment effectively with LRP, the very first step is to examine the details dangers your operation encounters, such as cost volatility or unanticipated climate occasions. Next off, it is vital to study and select a reputable insurance copyright that offers LRP plans customized to your livestock and service demands.

Long-Term Financial Safety And Security With LRP Insurance Policy

Guaranteeing sustaining monetary security via the use of Animals Threat Protection (LRP) Insurance coverage is a sensible lasting method for farming producers. By integrating LRP Insurance policy into their threat monitoring strategies, farmers can protect their animals investments blog here against unanticipated market changes and damaging occasions that can jeopardize their monetary health gradually.

One secret advantage of LRP Insurance for long-term economic security is the peace of mind it provides. With a reliable insurance coverage in position, farmers can alleviate the financial dangers associated with unstable market problems and unanticipated losses due to aspects such as illness outbreaks or all-natural calamities - Bagley Risk Management. This stability allows manufacturers to concentrate on the everyday operations of their livestock company without continuous stress over possible monetary problems

Moreover, LRP Insurance policy gives a structured technique to taking care of threat over the long-term. By setting details coverage levels and picking suitable endorsement durations, farmers can tailor their insurance plans to align with their financial browse around here goals and run the risk of resistance, making certain a secure and lasting future for their livestock procedures. Finally, investing in LRP Insurance is an aggressive technique for farming manufacturers to accomplish enduring monetary protection and safeguard their incomes.

Verdict

Finally, Livestock Threat Defense (LRP) Insurance coverage is an important tool for livestock manufacturers to mitigate market risks and protect their investments. By recognizing the advantages of LRP insurance coverage and taking actions to implement it, producers can attain long-lasting monetary safety and security for their operations. LRP insurance policy gives a safeguard versus rate variations and makes certain a degree of stability in an unpredictable market environment. It is a wise option for protecting livestock investments.

Report this page